In the ever-evolving landscape of business finance, check printing software has emerged as a powerful tool to streamline payment processes, enhance efficiency, and reduce the risk of errors.

Gone are the days of manually writing checks and keeping track of every transaction on paper. With the advent of check printing software, businesses can significantly improve their financial operations, reduce costs, and increase accuracy.

In this article, we will explore the many ways in which check printing software can empower your business.

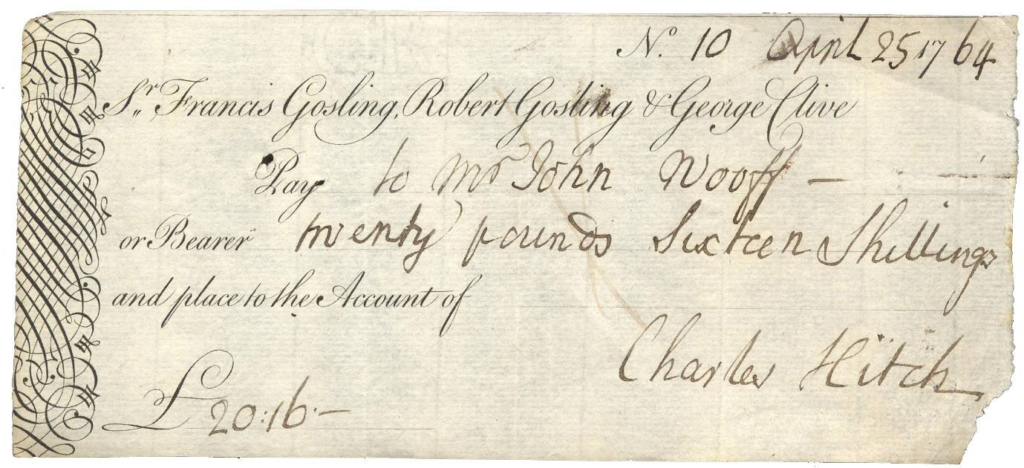

The Evolution of Check Printing

Traditional check writing, while once the norm, is no longer the most efficient or cost-effective method of handling payments in a modern business. There are several reasons why businesses are increasingly turning to check printing software as a solution:

1. Efficiency: Writing checks by hand is a time-consuming process, and it becomes increasingly cumbersome as your business grows. Check printing software can automate this process, saving significant amounts of time.

2. Accuracy: Human errors in check writing, such as incorrect amounts or payee names, can lead to financial and legal complications. Check printing software reduces the risk of such errors, enhancing accuracy.

3. Cost Savings: Pre-printed check stock and ink for handwriting checks can be expensive. Check printing software allows you to print checks on blank check paper, which is often more cost-effective.

4. Security: Modern check printing software incorporates security features such as digital signatures, watermarks, and encryption to protect your checks from unauthorized alterations and fraud.

5. Record Keeping: Check printing software maintains a digital record of all your transactions, making it easier to track payments, reconcile accounts, and generate financial reports.

6. Remote Access: Cloud-based check printing software enables you to manage your finances from anywhere with an internet connection, providing the flexibility needed in today’s business environment.

7. Eco-Friendly Approach: Transitioning to digital check printing is not just cost-effective but also environmentally friendly, as it reduces the need for physical resources like paper and ink.

The Benefits of Check Printing Software

Now that we understand why check printing software is becoming increasingly popular, let’s delve deeper into the benefits it offers to businesses:

1. Time Savings: Check printing software automates the entire check creation process, from entering payment details to printing checks. This significant time savings allows your finance team to focus on more critical tasks.

2. Enhanced Accuracy: With check printing software, you can avoid common mistakes in check writing, such as incorrect payee names or amounts. The software automatically populates the necessary fields, reducing the risk of errors.

3. Cost-Effective: By eliminating the need for pre-printed check stock and reducing the amount of ink used, check printing software can significantly reduce costs associated with check issuance.

4. Customization: Most check printing software allows you to customize the design, layout, and fonts of your checks. This feature enables businesses to maintain their branding and create professional-looking checks.

5. Security Features: Check printing software includes advanced security features like digital signatures, watermarks, and encryption to protect your checks from unauthorized alterations and fraud.

6. Record Keeping and Reconciliation: All check transactions are automatically recorded in the software, simplifying the process of tracking payments, reconciling accounts, and generating financial reports.

7. Remote Accessibility: Cloud-based check printing software allows you to access your financial data and print checks from anywhere, offering increased flexibility and convenience.

8. Environmental Responsibility: By reducing the need for pre-printed check stock and physical documents, check printing software contributes to a more sustainable and eco-friendly business operation.

How to Empower Your Business with Check Printing Software

To empower your business with check printing software, follow these steps:

1. Select the Right Software: Research and choose a check printing software that suits your business needs. Consider factors such as cost, features, ease of use, and integration with your accounting system.

2. Set Up the Software: Once you’ve selected the software, set it up by connecting your bank accounts and inputting your payee and payment details.

3. Customize Your Checks: Personalize the design and layout of your checks to match your brand identity.

4. Verify and Print: Before printing checks, double-check the payment information for accuracy. Once you’re satisfied, proceed to print the checks using blank check paper.

5. Record Keeping and Reporting: Utilize the software’s record-keeping capabilities to maintain a digital trail of your transactions. This data will be invaluable for financial reporting and reconciliation.

6. Security and Data Protection: Implement security measures within the software to safeguard your financial data. Utilize encryption, access controls, and other security features to protect your information.

7. Train Your Team: Ensure that your finance team is trained in using the software effectively. Familiarity with the software’s features and functions will help maximize its benefits.

The Challenges and Considerations

While check printing software offers numerous advantages, there are challenges and considerations to keep in mind when adopting it for your business:

1. Software Costs: Check printing software typically comes with subscription or licensing fees. Ensure that the software cost aligns with your budget.

2. Learning Curve: Transitioning from traditional check writing to digital methods may require training for your finance team. It’s essential to ensure they are comfortable using the software.

3. Internet Connectivity: Digital check printing relies on a stable and reliable internet connection. Ensure you have access to the internet, especially if you’re using cloud-based software.

4. Compliance and Legal Requirements: Different regions and industries may have specific compliance and legal requirements for check printing. Ensure that you are aware of these regulations and that the software can help you meet them.

Conclusion

Check printing software has transformed the way businesses handle payments, offering improved efficiency, accuracy, and cost savings.

By automating the check creation process, reducing the risk of errors, and providing enhanced security features, businesses can streamline their financial operations and enhance their overall performance.

As with any technological advancement, there are challenges and considerations when adopting check printing software.

However, the benefits of increased efficiency, accuracy, and cost savings far outweigh the drawbacks, making it a wise choice for businesses looking to empower their financial operations.

By embracing check printing software, your business can efficiently navigate the digital era and maintain a competitive edge in the ever-evolving world of finance.

Also Read: Empower Your Business with Check Printing Software