Taking out a personal loan can be confusing and stressful. But new technology is making the process much easier! According to US News Money, over 23 million Americans have personal loans. This figure indicates that advanced personal loan technology benefits a large number of people.

Faster Applications

Applying and prequalifying for a personal loan online took a long time. You needed to physically visit a lender and fill out paperwork by hand just to apply for a mortgage or test in case you had been prequalified for a personal loan. You can even prequalify for a personal loan completely online in under 10 minutes without affecting your credit rating!

Automated structures can swiftly pre qualify or pre-approve you via reading the information you enter on an online non-public mortgage application. If approved, you can signal your mortgage files electronically, too. This saves a lot of time for office work to be processed.

Instant Eligibility Checks

Automated eligibility checks use computer programs to instantly analyze applicant details. This determines if applicants qualify without needing a loan officer to manually review case-by-case.

When you apply, automation immediately compares your information to qualification criteria. It checks things like income, credit score, and current debt balances.

If you meet the requirements, you get instant confirmation that you are eligible instead of waiting. If you don’t initially qualify, you will also find out faster.

Data-Backed Credit Decisions

Credit decisions used to rely on the limited borrower history available to loan reviewers. Now, computer modeling evaluates thousands of available data points in seconds to enable customized quotes.

Automation collects and interprets elements related to financial habits that impact loan qualification. This includes everything from purchase types to regular bill payments and even social media connections.

By assessing many personal finance signals – not just credit reports – automated systems approve applicants who may not have qualified traditionally. More data leads to more approvals and better-qualified applicants.

Personalized Loan Offers

Every borrower has unique needs. Automation helps lenders understand your unique situation.

When you apply for a loan online, algorithms analyze facts about you. This includes your income, existing debts, credit history, and more.

The system then suggests loan offers tailored to your profile. This makes it more likely you could qualify and be able to manage repayment.

The quantity, size, and terms of your personalized loan options are all determined by your circumstances. This level of personalization was not possible before automation.

Reminders for Repayments

Remembering when each monthly payment is due can be hard. Missing payments result in late fees and other penalties.

Loan servicing platforms now leverage automation to monitor repayment schedules. When a due date approaches, a text or email reminder goes out.

Some systems even let you link your account. Payments are then withdrawn automatically each billing cycle.

Tools like reminders and auto-pay take the stress out of making sure payments arrive on time every month. They reduce mistakes caused by lapses in memory.

Quick Answers to Questions

Having questions about your loan documents or terms is normal. But getting the right answers used to require phone calls during financial institution working hours.

Chatbots, powered by artificial intelligence, are now available 24/7. When you have a question, you simply type it in. Responses are provided in seconds!

Virtual assistants like these understand common loan-related questions. Over time, they learn the correct answers based on real customer interactions. This means the information they provide is accurate and up-to-date.

The convenience of getting immediate responses at any hour is invaluable. Chatbots normalize the lending experience and provide useful support.

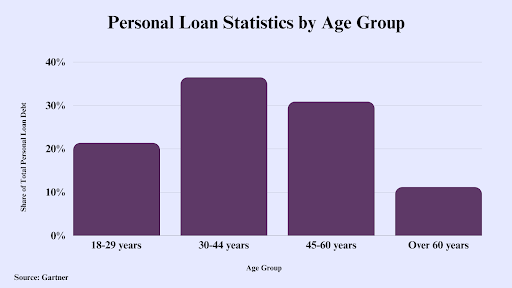

One important aspect that chatbots can address is questions about who takes out personal loans. The chart below illustrates the percentage of total personal loans held by various age groups across the country.

As you can see, people aged 30 to 44 have more than one-third of all personal loan debt.

Ongoing Process Improvements

Behind the scenes, automation tracks every customer interaction with lenders. Algorithms analyze these billions of data points over time.

By detecting usage patterns and pain points, systems learn how to refine processes. Improvements then get implemented across all platforms.

This constant feedback loop leads to better online forms, smarter eligibility checks, more relevant loan offers, and more. Upgrades roll out on a weekly or even daily basis.

The result is a smoother, easier lending process that improves continuously thanks to automation. Customers enjoy the benefits of faster approvals, better options, and less hassle.

Real-Time Loan Tracking

After getting approved for a loan, it is important to monitor your account. In the past, you had to wait for monthly statements to know balances and due dates. This often led to surprises with fees or penalties.

Now automation lets you check in anytime. Mobile apps and online dashboards display real-time details on balances owed, recent payments, interest charges, and more. Staying updated prevents you from falling behind.

Enhanced Data Security

With more lending functions happening online through automation, data breaches are a risk. Hackers might access private information and exploit customers. Preventing attacks is crucial.

Artificial intelligence assists by detecting unusual activity and strengthening firewalls 24/7. Two-step login and biometrics like fingerprints and facial recognition also boost safety measures and reduce fraud.

This vigilance assures borrowers that personal details stay private as automation spreads.

Improved Customer Support

Even with more tasks automated, borrowers sometimes need to talk to an actual person. Waits used to be long, especially during busy periods. This caused frustration and delays in getting needed help.

Now, virtual assistants can handle common requests like balance checks, payment updates, and deadline changes. This leaves human representatives free for more complex issues. As calls are appropriately rerouted, hold times decrease.

Customers receive faster, more satisfying support thanks to automation balancing the load. This improves brand loyalty too.

In Conclusion

New technology has seemingly transformed every industry over the past decade, and lending is no exception. Automation now powers multiple stages of the personal loan process.

From easier applications to custom offers to repayment reminders and beyond, automation simplifies every step. Borrowers can access funds quicker with less stress.

While taking out any loan is a big decision, automation gives you confidence that you are getting the best rate for your situation. It also provides helpful support, so repaying goes smoothly.

As automated systems process more data and gain more real-world experience over time, expect an even better borrowing experience in the future!

FAQs

- What is a private loan?

A personal loan is money borrowed from a lender which you repay with a hobby over a hard and fast time. You can use a private mortgage to pay for scientific bills, home repairs, holidays, or massive purchases.

- How do I qualify for a personal mortgage?

For a private mortgage qualification, creditors investigate your credit score, income, and current debts. An exact credit score and a vital job usually help you get authorized. Lenders need to look that you could pay off what you borrow.

Three. Are there exclusive styles of non-public loans?

Yes, there are some different sorts. Standard options encompass instalment loans with constant month-to-month payments, traces of credit with flexible draw amounts, and unsecured loans, depending on the requirement for collateral. Read the satisfactory print to apprehend which mortgage terms work quality to your situation.